The popularity of electric vehicles continues to rise along with the concern the apparent climate emergency that planet earth faces. The Government of Canada is supporting a transition away from fossil fuel based passenger vehicles, and many car markers are moving forward with the development of electric vehicles in most market segments. But, consumers are still treading carefully before purchasing an EV (electric vehicle). There are certain questions that many consumers may have before they decide on an electric vehicle as their next car purchase.

1. Can an electric vehicle fit my lifestyle?

2. How much money can I save driving an electric vehicle?

3. Will maintaining an electric vehicle cost less?

4. Where am I going to charge my EV?

5. How long will it take to charge my EV?

These are important questions that you should be asking yourself, and we are here to provide you answers.

Electric Vehicles and Your Lifestyle:

Electric Vehicles and Your Lifestyle:

When you are considering purchasing an electric vehicle, you need to think about what kind of lifestyle you currently have. For example, individuals that drive long distances every day, may be quite nervous about the possibility of running out of power to make it home each day.

Although the first thing you would think of when looking at an EV is your daily commute to either work or school, there are a few other factors that you should consider as well. Do you travel to the cottage often? Are there long distances that you will be driving outside of your regular work week? For someone that lives and works in the city, and doesn’t do much traveling, an EV would be an ideal vehicle for them. But, for a large family that plans on driving four hours every weekend, they may have to consider other options. The range on your EV is a function that should fit in with your lifestyle. Interestingly, most current EV owners charge their vehicles at home. So as long as you can get to your home or cottage, distances of up to 300 kilometres are achievable with the EV technology available today.

The bottom line is that if your daily travel adds up to less than 200 kilometres, an EV is almost certainly going to get you everywhere you are driving to.

How Much Money Can I Save With an Electric Vehicle?

How Much Money Can I Save With an Electric Vehicle?

If we consider the costs of how much an electric vehicle adds to your electric bill, and how much a level 2 charger would cost to install, we need to make a comparison to how much would be spent on a gas powered vehicle. On average, as little as $300 is added to your electricity bill per year if you were to always charge your vehicle at home. Whereas with gas powered cars, the average Canadian spends upwards of $1500 per year on gas alone, and pickup truck owners or individuals that do a ton of commuting can spend up to $3000 on gas per year. Although a good level 2 charger can cost around $800 upfront, and about $500 to install, the cost of $1300 would be $200 less than what the average Canadian spends on fuel every year.

To sum it up, it is very likely that your cost to fuel your EV will be greater than 50% lower than the cost to fuel a comparable gas powered vehicle.

Will I Save Money Maintaining an Electric Vehicle?

Will I Save Money Maintaining an Electric Vehicle?

Something that most vehicle owners should consider before purchasing anything is how much maintenance is going to be required for their car and how much it will cost for regular maintenance and unscheduled maintenance. It is typically recommended that you change your oil every six months, and oil changes start at about $40 on average. This does not take into account vehicles that use synthetic oil like many imports and higher performance vehicles. Fortunately, electric vehicles do not require any oil changes. Maintenance items on an EV are tires, suspension and brakes. There are countless items that may need regular or unscheduled maintenance on an ICE (Internal Combustion Engine) which will add hundreds, if not thousands, to the total cost of ownership. This is because there are so many working parts in a gas powered engine, and these parts will need to be replaced over time. Although people looking to purchase an electric vehicle should know that there are a few items that will need to be maintained over time, you will not be doing tune-ups and most of the other required scheduled maintenance. Therefore you are reducing your maintenance costs significantly with an EV. If you are an individual that is very keen on saving as much money as possible with their vehicle, an electric vehicle should be the first type of car you should consider.

In conclusion, depending on how much you drive, you may save over $100 per month, just on fuel. The more you drive, the more you will save. This does not take into account the reduced maintenance costs of an EV.

Where Will I Charge My Electric Car?

Where Will I Charge My Electric Car?

There are approximately 5000 electric vehicle charging stations across Canada, and most of them are located in Ontario, British Columbia and Quebec. In comparison, there are as many as 12,000 gas stations across the nation, which is more than double the amount of charging stations, so there is still a long way to go.

But wait a moment, why would you stop at a gasoline station if you could fill up at home? For the majority of consumers that own electric vehicles, their primary location to charge their vehicle is in their own garage. EV owners rarely use charging stations that are away from their home.

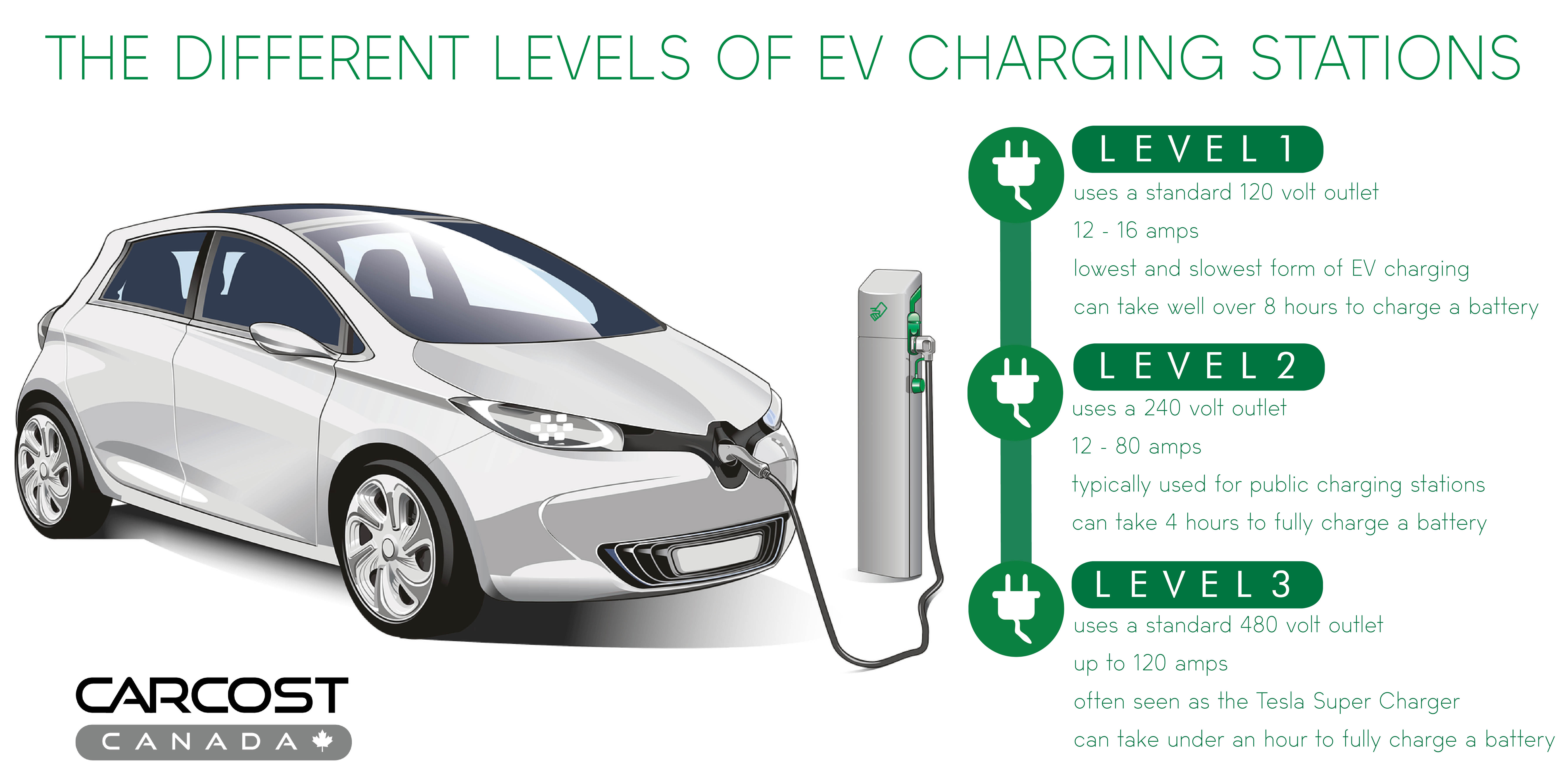

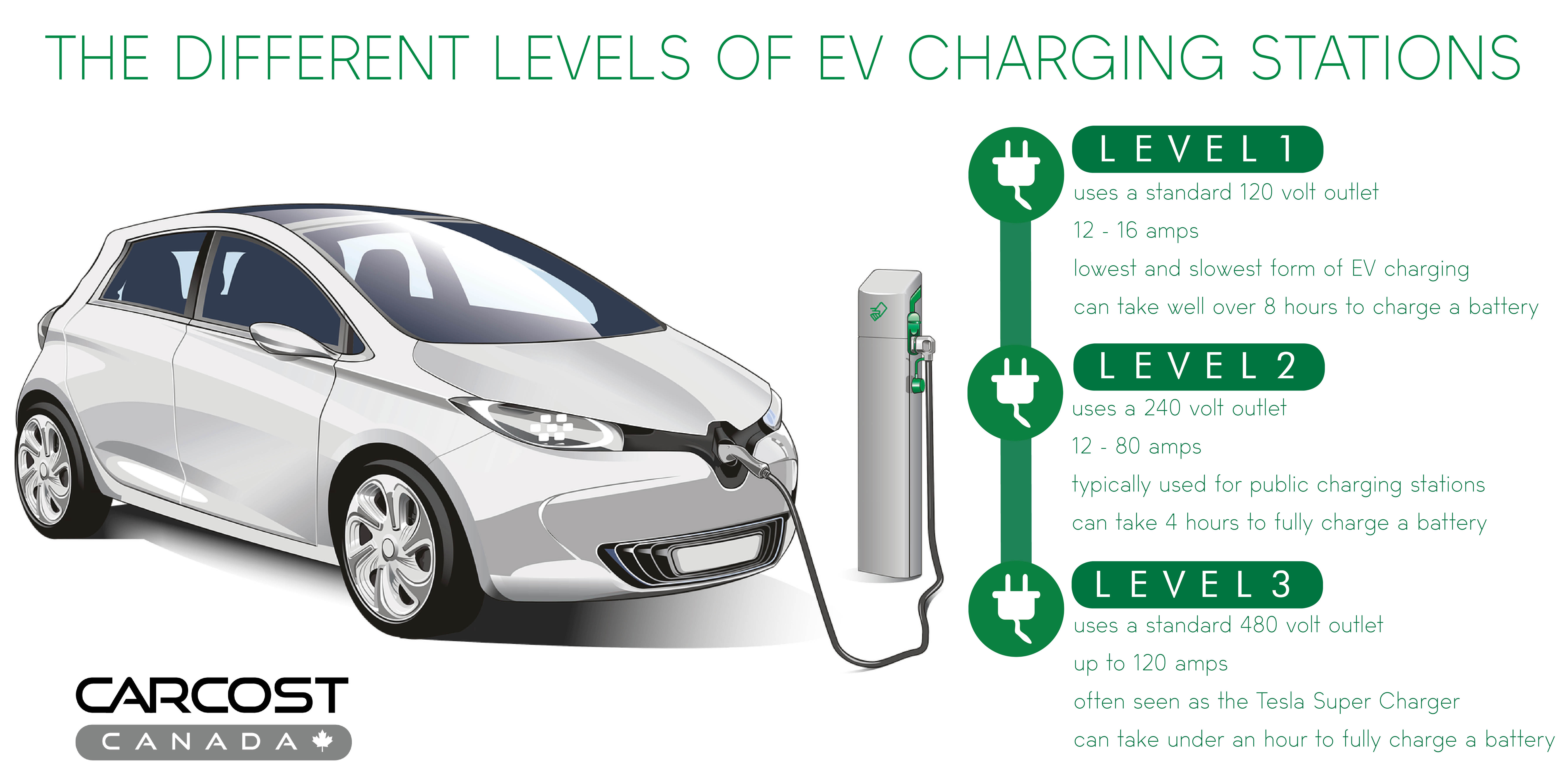

Electric vehicles can be charged using the current from a typical household outlet. This is commonly referred to as Level 1. For vehicles that have larger (longer range) battery systems, level 1 charging ports can be extremely slow and would not suffice for models that have a range of over 300 km. Types of vehicles under this category are models like the Nissan Leaf, Chevrolet Bolt, and various Tesla models. Models like the Chevrolet Volt or the Fiat 500e can rely on level 1 charging stations, and can have a full battery by the next morning.

Level 2 chargers, operate at 240 volts AC. These systems significantly boost charging performance. Typically, a level 2 station can provide 40 kilometres of range per hour. As for level 2 chargers, home installation kits are readily available to consumers who directly control their local electricity account. People living in high rise condominiums may experience challenges getting access to charging infrastructure, but luckily many new condominium buildings have charging stations in their parking garage that are accessible to tenants. Often a level 2 charging system can be purchased for around $1000 and installation costs of approximately $500 are not uncommon.

Although most electric vehicle owners do not drive more than 300 kilometres in a day, having a level 2 charging station in your home will add convenience and peace of mind. The ritual of visiting stations that sell gasoline or diesel fuel, may become a thing of the past.

Although most electric vehicle owners do not drive more than 300 kilometres in a day, having a level 2 charging station in your home will add convenience and peace of mind. The ritual of visiting stations that sell gasoline or diesel fuel, may become a thing of the past.

Tesla is marketing roofing systems that connect solar roof shingles, to a battery pack located in the home. The idea being that the battery system can power the home, in place of other electricity supplies. This system is clearly still in its early stages of development and it is likely that the cost of this system will come down in the future.

Level 3 charging systems also known as DC Fast Charge, operate at 480 volts DC. These systems are not typically available in homes, as they require a ton of power. The best known and most common Level 3 system is the Tesla Supercharger network. There is a growing number of Level 3 charging stations being deployed across Canada. The objective of these systems is to get the vehicle back to 80% capacity in less than one hour. When you are in the midst of a long drive, a one hour stop might seem like a huge waste of time. It is possible that wrapping a charging stop around a meal, time to catch up up with your digital friends and other things that you should not be doing while driving will make the time quite productive.

Bottom line; most EV owners love the convenience of charging their cars at home. It is rare that you will hear anyone suggest they miss stopping for gasoline on those cold winter nights. For the vast majority of Canadians, with some planning, charging your EV is not going to be inconvenient.

How Long is it Going to Take to Charge My Electric Vehicle?

How Long is it Going to Take to Charge My Electric Vehicle?

The time required to charge your EV is totally dependent on the system you are connected to & the battery capacity of your vehicle.

If you connect your EV to a Level 1 system (basically a standard wall outlet) its going to take 20 hours to add 200 kilometres of range. If you attempted to charge a Jaguar I-Pace at Level 1, it could take over 40 hours to reach a full charge.

Level 2 systems (which is what we strongly recommend all EV owners install), are so much faster that most vehicles can be fully charged overnight while parked in the garage. Adding 200 kilometres of range will take about 5 hours, and adding 400 kilometres of range will take between 10 and 11 hours. It should be noted that many EV manufacturers recommend only charging the vehicle to a level of charge that is aligned with the amount of driving you are going to do.

In other words do not fully charge your Tesla Model 3 Long Range up to its 500 kilometre range every night if you are only going to drive 60 kilometres every day.

Level 3, DC Fast Charge systems are awesome! Adding over 350 kilometres of range in less than one hour is common for these types of units.

The bottom line is that with installing a Level 2 system at home is going to make being an EV a pleasure. When you are on a road trip, plan your overnight stops around the location of available Level 2 or Level 3 charging stations.

To Summarize

Many Canadians could already easily adapt to electric vehicle ownership. There is a lot of money to be saved. Charging your electric vehicle will be easiest at home, but you can certainly plan for charging away from home. Depending on your specific requirements in the following specific areas (passenger capacity, cargo capacity, range) the right EV might already be available. If its not already available, it will probably be in the near future as almost all automakers move towards the electric power to meet the demand for climate friendly vehicles.

Article by: McKenzie Dolan

Electric Vehicles and Your Lifestyle:

Electric Vehicles and Your Lifestyle: How Much Money Can I Save With an Electric Vehicle?

How Much Money Can I Save With an Electric Vehicle? Will I Save Money Maintaining an Electric Vehicle?

Will I Save Money Maintaining an Electric Vehicle? Where Will I Charge My Electric Car?

Where Will I Charge My Electric Car? Although most electric vehicle owners do not drive more than 300 kilometres in a day, having a level 2 charging station in your home will add convenience and peace of mind. The ritual of visiting stations that sell gasoline or diesel fuel, may become a thing of the past.

Although most electric vehicle owners do not drive more than 300 kilometres in a day, having a level 2 charging station in your home will add convenience and peace of mind. The ritual of visiting stations that sell gasoline or diesel fuel, may become a thing of the past.

How Long is it Going to Take to Charge My Electric Vehicle?

How Long is it Going to Take to Charge My Electric Vehicle?