You’re in the market for a new car!

There’s nothing quite as exciting as checking out all the makes and models, narrowing down your list and test driving those final few. As fun as this is, there are certain hitches throughout the process that can trip you up, especially when it comes to that tricky test drive.

In this article, we navigate you through this elusive art, and also explain why it’s so so SO important to familiarize yourself with the car’s dealer invoice price in Canada before putting down your money.

A dealer invoice report breaks down the MSRP (how much the dealer paid to own the vehicle), factory incentives, financing options, and more! So for example, if you’re curious about the BMW series 8 dealer price in Canada, a dealer invoice report is your secret weapon to making the negotiations process simpler.

Without further ado, let’s delve into the different techniques to adopt when test driving your dream car.

Research, Research, Research

We urge you to read reviews from people who’ve test-driven the same model before, get a dealer invoice report and effectively narrow down your top picks. The last thing you want to do is test drive more cars than you need to.

Create a checklist that meets your main criteria. When you do your homework, it’s much easier to identify the things you want and don’t want in the car and by default, it becomes easier to identify the things you like or dislike during the drive!

Bring a Buddy

Granted, you may not be a car savant, and that’s okay. Bring along a family member or friend. Even if they’re not as savvy themselves, that extra pair of eyes elevates the chances of noticing something that you may not.

Plus, they can provide valuable feedback as to what it’s like to ride as a passenger in the vehicle. Inexperienced buyers greatly benefit from bringing someone along as there are many potential concerns that crop up during your negotiations with the dealer that call for added support.

Inspect the Vehicle

Yes, looks matter! Conducting a visual inspection is as important as getting behind the wheel and giving the car a whirl. What to look for?

- Make sure the size is optimal, and that the car will easily fit into your garage; break out the measuring tape if you must!

- Inspect the cargo space and glove compartment; too much or too little will be a problem later on.

- How about that legroom? The interior space should be sufficient for the driver and front and back seat passengers.

- Adjust the seats to see if this can be done quickly and comfortably.

- Try out the Bluetooth, GPS and radio to make sure there are no glitches.

- Experiment with the buttons and knobs to ensure that everything is accessible and intuitive to use.

Get a Dealer Invoice Report

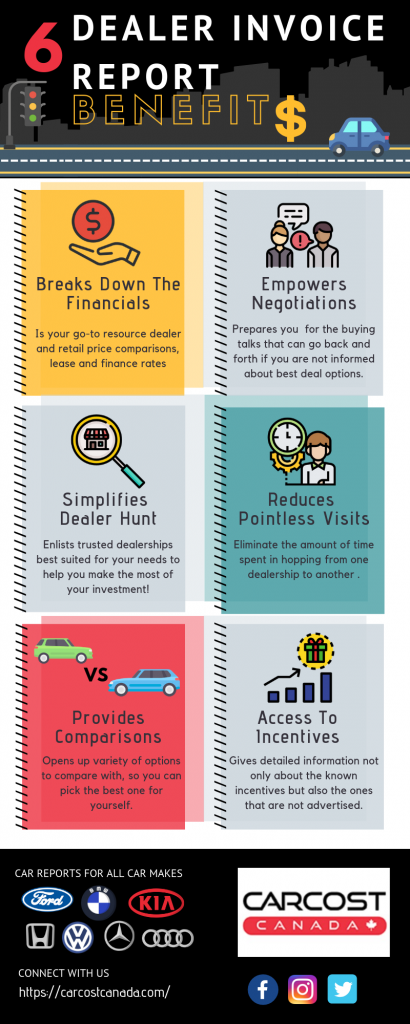

Now you may be wondering; how is a dealer invoice report vital to my test drive? As it turns out, this handy report is vital to not just your test drive but the entire buying process. Allow us to explain.

When you select a make and model and request your free report, you will immediately gain access to the following information;

- MSRP (Manufacturer’s Suggested Retail Price – what the dealer paid to own the car)

- Factory incentives

- Lease and finance rates

- Recommended dealerships

- Vehicle pricing options

- Comparable vehicles

With this information, you can access certified recommended dealerships and the negotiation process then becomes a breeze.

A majority of dealerships make a profit of 8.7% on selling a new vehicle. When you know the MSRP, follow the 3-5% rule – add 3-5% on the invoice figure in your report to calculate the most lucrative negotiation price!

Test driving is nothing by itself if you don’t get a good price without breaking your budget, right? Right! That’s why we encourage you to get a free report today – no matter the make and model you have in mind, we got you covered.

We’re here to help. Request your free dealer report right now.